Hey guys, so I know I haven’t posted in a while but as you know the holidays can be a busy time and I’d rather blog for fun instead of feeling like it’s a chore. That being said I am hoping to post once a week from this point on! This week I wanted to talk about budgeting. I know a lot of people have started their New Year’s resolutions and many people I’ve talked to want to start focusing on saving money (esp after the holidays). I’ve been budgeting on and off for about a year and a half now and there are a few things I’ve found that work really well and other’s that don’t. Overall, the key is finding the best fit for your financial goals and income.

First and foremost I want to point out that budgeting is more of a lifestyle change than a temporary fix. Sure you might start a budget to help save for that new car or fabulous vacation you want to take but in reality you are always going to have something you need to save money for. I like to compare budgeting to losing weight; you have to start out by dieting but in order to maintain that weight you must change your eating habits permanently. The same goes for budgeting and saving money. That being said, I’ve found it’s best to start with small changes and work your way up to bigger savings.

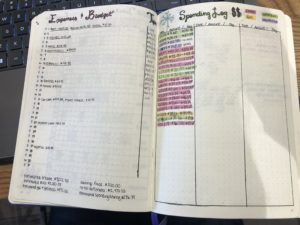

The first thing I did when creating a budget was writing down my income. This was difficult for me as I am paid hourly and make tips so my income varies from week to week. To solve this I took my net income for each check I received last year and came up with an average amount of tips I make weekly. For the tips I focused on the lower end of the spectrum and I specifically did not add a percentage increase for my yearly raise so I don’t overspend my budget. If anything, I make more than what I plan so I can either save more or have extra spending money.

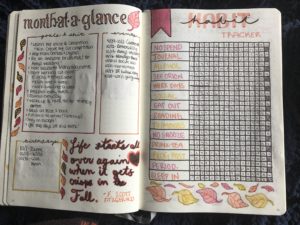

Once you have the base for how much income you plan to receive you can then move on to writing out your monthly expenses. This would include monthly bills like rent, car payment, internet etc. as well as any subscriptions that come out of your accounts. Then you need to make a budgeting cap for how much money you want to spend on groceries and gas each month as these things may vary depending on what you need from the store or how much gas prices are. If you have credit card debt you want to pay off make sure you include the amount you’d like to put on your credit cards each month too. Finally you’ll want to have a saving’s goal–as in how much money you’d like to put into savings each month.

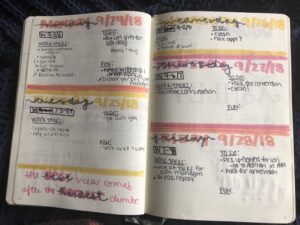

Got all that? Great, now you can calculate how much spending money you get for the month! Take all of those bills, savings goals and credit card payments and add them up then subtract that amount from your calculated monthly income–this is your spending budget. Don’t freak out if it’s low! Obviously you may spend more than this because things do come up but giving yourself a limit helps you make decisions between wants and needs. If your spending allowance is negative or extremely low then adjust your savings goal, grocery budget or cut where you can in your monthly expenses to have a bigger spending limit. Keep a spending log each month so you can see how much you are spending extra cash and where that money is going. Then ask yourself if these purchases were “wants” or “needs.” It may help to make a running list of wants and needs to help you decide whether or not something is worth spending your money on. Also, don’t be hard on yourself if you don’t hit your goals every month! Just vow to do better next month.

This process is what I’ve found works for me. It’s simple enough that it only takes about 15-20 mins to set up and a few minutes daily to update. Some months I follow it religiously while others I slack but I always find myself coming back to this method. Also when I am trying to save for something specific I think about what I’m saving for before I make a “want” purchase. This helps me save money in the long run because most of the time the “want” is not worth being father away from my savings goal. I hope this helped in some way with your budgeting goals and I’d love to hear more ideas on how to save/budget effectively so feel free to share! Thanks!

<3 Ash